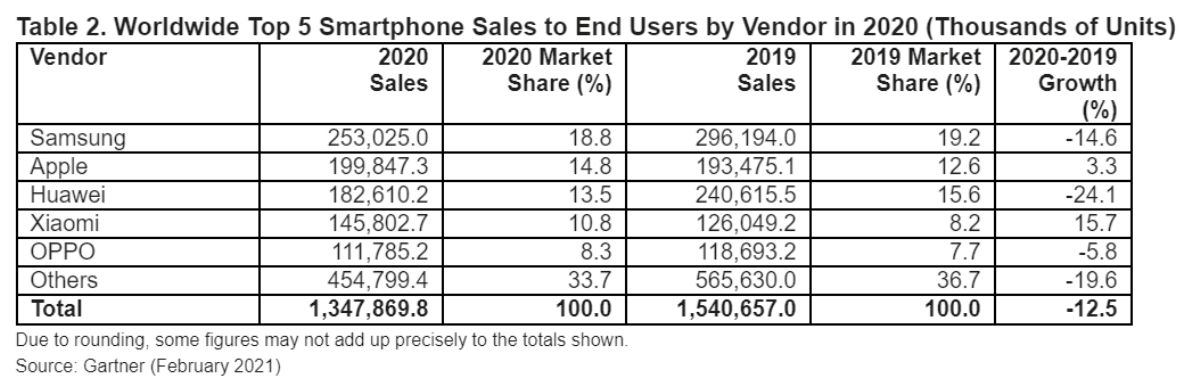

New analysis released by tech research firm Gartner shows that smartphone sales dropped significantly last year with sales down 12.5% over the full year.

Just over 1.3 billion smartphones shipped last year, a major dip compared to 2019, which saw a total 1.5 billion devices sold. Worried by the economic impact of the global health crisis, consumers pulled back on spending, holding off some discretionary purchases. Phones, as it turns out, did not always make it to the list of essential products to replace.

The lack of consumer spending brought the market from “stagnating” to “declining,” explains Annette Zimmermann, analyst at Gartner. “If we go back to December 2019, before the pandemic, we were predicting a flat market for 2020, because of weaker demand overall and weaker products with little technological innovation,” Zimmermann tells ZDNet.

“So, obviously, there was an even stronger negative trend in terms of consumer sentiment. The biggest problem came from consumers’ spending behavior, because of the economic situation.”

It’s not all doom and gloom. The last quarter of 2020 showed early signs of recovery: global sales of smartphones only declined by 5.4%, largely driven by Apple’s launch of the 5G iPhone 12. The Cupertino giant, as a result, recorded double-digit growth in the last part of the year, with sales hitting almost 80 million devices.

Analysts have long anticipated that Apple’s first 5G-enabled smartphone would trigger a supercycle for smartphone shipments, as iOS users start seeing the value of replacing their devices. The prediction now seems to be unfolding as planned, despite the adverse effects of the COVID-19 crisis.

Apple’s new release at the end of 2020, in fact, helped the company propel itself to the top of the sales charts in the last months of the year, taking the number one global smartphone vendor spot for the fourth quarter. In doing so, the iPhone manufacturer overtook Samsung, which had previously dominated the market.

“Samsung lost to Apple here because of the new iPhone, which Samsung didn’t have much to put up against,” says Zimmermann. “The Apple product was really the one people were looking for, and Samsung couldn’t benefit from upgrades coming from their own user base. So it was really all on Apple.”

That is not to say that the race is over. Looking at the whole of 2020, and despite an overall decline, Samsung nevertheless retained the largest number of sales (253 million devices shipped), as well as the largest market share, with almost 19% of the market – ahead of Apple, which holds under 15% of the market.

The two smartphone manufacturers are likely to keep chasing each other in the years to come. Zimmermann, for her part, is confident that Apple’s last-quarter growth doesn’t necessarily mean that the company will sustain its lead over Samsung. “This is just for one quarter,” she says. “But in the next few quarters it’s nearly certain that Samsung will be leading again, or on par.”

In the near-term, however, Apple is expected to keep building momentum. With the iPhone 12, the Cupertino giant can only expect to grow as the market for 5G devices expands, and consumers continue to upgrade their phones to start benefitting from better connectivity.

The entire industry’s prospects, in fact, are looking better for the year to come: Gartner previously predicted that, driven by 5G uptake, 2021 would see the number of devices shipped grow by 11.4% globally and come close to the levels seen in 2019 again.

Much of the consumer spending that was put aside in 2020, therefore, can be expected to happen this year instead – especially as more 5G-enabled devices are made available, and at ever-lower costs. Gartner’s analysts expect that 5G-enabled devices will constitute 35% of total smartphone sales in 2021.

Next to Apple, only one smartphone vendor experienced growth in 2020: Chinese manufacturer Xiaomi, which saw its share of sales jump by almost 34% since 2019, to more than 11% of the market.

Xiaomi’s growth can be partly attributed to Huawei’s woes. After Huawei was added to the US Department of Commerce’s Entity List, Google took the decision in 2019 to suspend the company’s use of some parts of the Android operating system, meaning that the devices since then lack some applications that are key to consumers, especially in European and North American markets. Gartner’s latest analysis, in fact, shows that as a result of the ban, Huawei recorded the highest decline among the top five smartphone vendors in 2020.

“Companies like Xiaomi are probably the biggest beneficiaries of the decline of Huawei,” says Zimmermann, “with double-digit growth over the past 18 months.”

“Of course, when you look at regional breakdowns, the vast majority of volume comes from China, but we’ve certainly observed growth in Europe. It is still quite a small base, but with very strong growth.”

Although so far, the battle seems to have been playing out between giants like Apple and Samsung, some emergent players are gaining strength in the market. The trends that will come out of the next year are already looking more exciting than what 2020 had to offer.