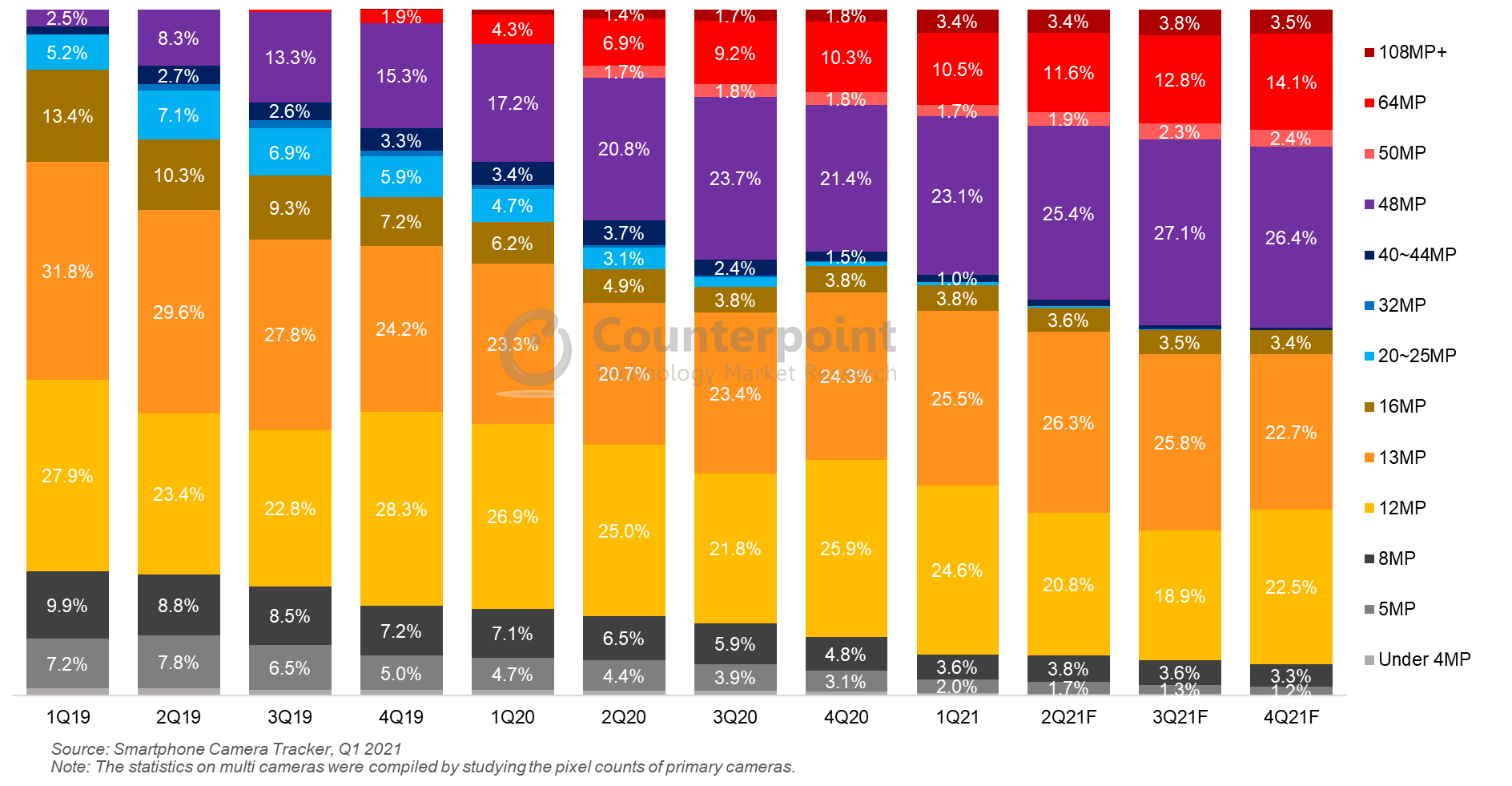

- For the rear main camera, demand for 48MP and above resolution returned to growth, collectively accounting for 38.7% of total smartphone shipments in Q1 2021.

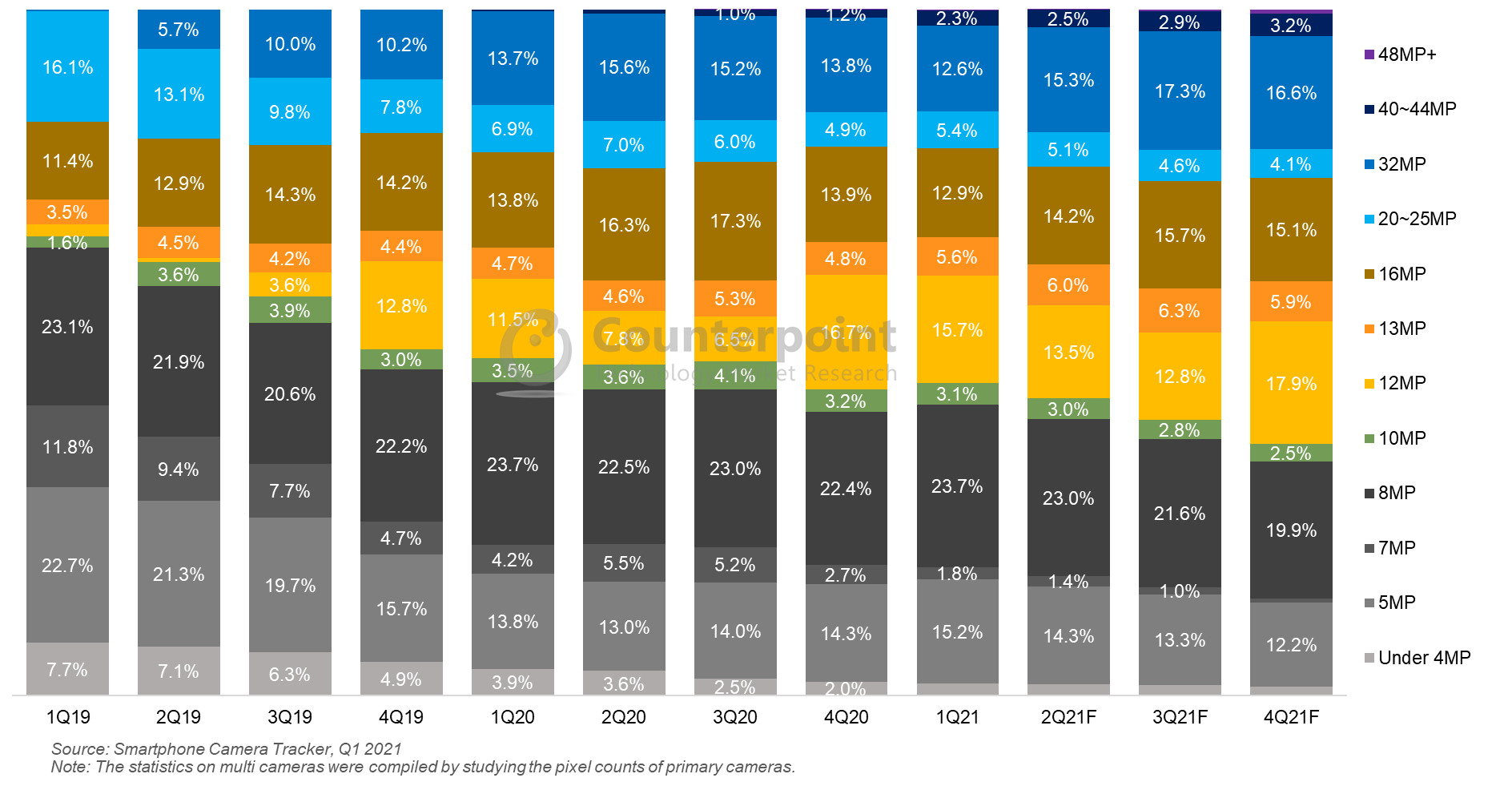

- For the front main camera, the share of 16MP and above megapixel counts edged down to 33.2%, down 0.7 percentage points from Q4 2020.

Amid the global COVID-19 pandemic and accelerating 5G penetration in affordable smartphones, the mobile camera specifications continue to improve with the ever-increasing adoption of high-resolution and large-area imaging sensors in both rear and front cameras.

Commenting on the shift towards higher megapixel counts, Research Analyst Alicia Gong said, “With 5G capability spreading to lower price segments, the cost of a smartphone RF front-end subsystem alone has increased by 50% with additional frequency band support. The increase in bill of materials (BoM) cost, particularly for low-end to mid-end smartphones, had temporarily slowed down the resolution improvement in Q1 2021. However, the demand for high-resolution main cameras will continue to increase. The upward trend is expected to accelerate with the mass production of sub-7µm image sensors by the year-end.”

- Smartphone Rear Main Camera Trends

Exhibit 1: Composition Ratio of Smartphone Rear Main Cameras by Resolution (%)

According to the findings from Counterpoint’s Smartphone Camera Tracker, Q1 2021, the shipment share of 108MP jumped to over 3.4% in Q1 2021, primarily driven by the implementation of 0.8µm-pixel-based Samsung S5KHMX and S5KHM3 in the Xiaomi Mi 11 and Samsung Galaxy S21 Ultra. The more affordable 0.7µm-based S5KHM2 sensor will further push up the 108MP share with growing adoption by value-for-money models from Redmi, HONOR and realme.

According to the findings from Counterpoint’s Smartphone Camera Tracker, Q1 2021, the shipment share of 108MP jumped to over 3.4% in Q1 2021, primarily driven by the implementation of 0.8µm-pixel-based Samsung S5KHMX and S5KHM3 in the Xiaomi Mi 11 and Samsung Galaxy S21 Ultra. The more affordable 0.7µm-based S5KHM2 sensor will further push up the 108MP share with growing adoption by value-for-money models from Redmi, HONOR and realme.

The demand for 64MP continues to increase as it has become a sweet spot for the wholesale price band of $300-$499. This resolution also expands its share in lower price segments like $200-$299 and even $100-$199, although the shift to 64MP from 48MP slows down due to the BoM cost increase, particularly in 5G smartphones.

The 50MP share temporarily declined primarily due to the decrease in Huawei’s premium smartphone shipments. However, we expect the share to return to growth from Q2 2021 as more Android brands start equipping their flagship models with big-pixel (1.2~1.4µm 50MP) and large-area image sensors.

With a good cost performance balance (0.7/0.8µm sensor alone costs $4-$5), 48MP is taking much of shipments across multiple price segments. Within the $100-$199 price band, the collective share of 48MP and 64MP reached 46% in Q1 2021. Both resolutions are becoming mainstream and will have a long-lasting impact on the rear camera design.

There is little room left for the 20MP-44MP zone and the proportion of 16MP also tends to decrease.

Regarding 13MP and 12MP, the two still commanded the largest shipment share in Q1 2021 with 25.5% and 24.6% respectively. 12MP has a broad mix of offerings, and the 1.4~1.8µm 12MP-based rear primary cameras have been in great demand in mid-to-high smartphones (wholesale prices above $300).

The proportion of the 8MP and below segment edged down to 6%, as demand for low-end smartphone (wholesale prices below $100) rear cameras continued migrating to 1.22/1.25µm 12MP or 1.12µm 13MP.

- Smartphone Front Main Camera Trends

Exhibit 2: Composition Ratio of Smartphone Front Main Cameras by Resolution (%)

The resolution of the front-facing camera is also improving continuously to shoot super-clear selfie images. In Q1 2021, the collective share of 20MP and above resolutions was back above 20%, and the high demand will continue with widespread adoption across multiple price segments.

The trend is expected to accelerate on the back of advancing pixel technologies. In June 2021, Samsung released the world’s first sub-7µm (0.64µm) pixels-based 50MP image sensor, ISOCELL JN1, with a 1/2.76-inch optical format. The sensor can fit in small head cameras.

The share of 16MP came down to 12.9% in Q1 2021, as many low-end to mid-end 5G models adopted 13MP (1.0/1/12µm) or 8MP (1.12/1.22µm) to offset the cost increase. However, the demand for 16MP@1.0µm sensors is expected to revive, particularly within the $100-$299 price segment.

In Q1 2021, the collective share of 10MP-13MP was almost flat at 24.4% compared to the previous quarter. It was backed by strong sales of the Apple iPhone 12 series, Xiaomi Redmi and Samsung Galaxy models across multiple price bands. As the volume of 12MP front cameras is heavily dependent on Apple’s performance, a V-shaped trajectory of share change is expected through 2021, with the forthcoming Apple launches likely to stick to the resolution.

The collective share of 8MP and below slightly increased to 42.4% in Q1 2021, up around 1 percentage point from Q4 2020. 8MP alone accounted for 23.7% of total volume and remained the most adopted resolution for front camera design in terms of smartphone shipments.

Moving forward, the share of 16MP and above resolution will further increase and the demand for low pixel sensors (≦8MP) will gradually decrease.

Note: The price segments appearing in this article are based on wholesale prices and not retail prices.