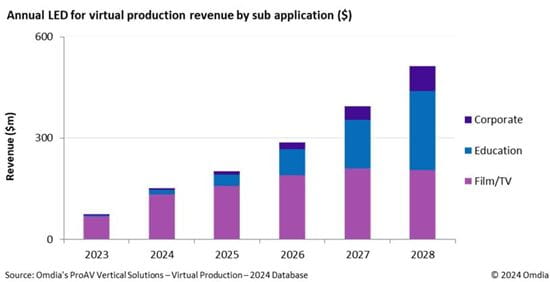

LONDON, April 17, 2024 – Total revenue (including hardware, software and cloud processing) associated with the Virtual Production (VP) market is forecast to reach over $1.1bn in 2028, up from $138.7m in 2023, thanks to widespread use in filmmaking and new use cases in corporate and education settings, according to Omdia’s new ProAV Vertical Solutions – Virtual Production 2024 Analysis.

“The prominence of virtual production has grown significantly as more powerful technology has evolved, rapidly improving its effectiveness,” said Matthew Rubin, Principal Analyst at Omdia. “Global events such as the COVID-19 pandemic also accelerated adoption, as workflows were forcefully impacted.”

Virtual production is a cutting-edge filmmaking technique that seamlessly merges physical and digital elements in real-time, enabling filmmakers to create immersive and dynamic environments on set. Through the integration of advanced technologies like high-resolution LED walls, motion tracking, and virtual cameras, live-action scenes can be captured within digital backdrops, allowing directors and cinematographers to visualize and adjust the final composition during filming.

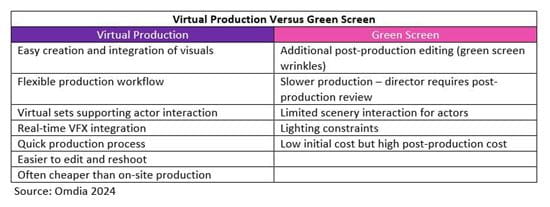

While the benefits of VP for filmmaking are relatively well understood, with obvious and comparable benefits versus green screens, corporate and educational use cases are still evolving. In corporate settings, companies such as SmartStage and Vū are spearheading the use of the technology, with simplified turnkey solutions and subscription to support more effective training, marketing, and collaboration. Many installations have already been implemented at higher education institutions, offering a transformative tool for enriching learning experiences as well as offering future commercial opportunities.

Early frontrunners in the VP space include LED vendors such as ROE Visual and AOTO (which combined have over half of the market share in 2023 in terms of volume), but with aggressive growth strategies in this area from the likes of InfiLED, Sony, and SiliconCore, among others, the competition is catching up quickly.

This leveling of the competitive landscape is helped by increasing standardization across the market in terms of technology requirements, such as the growth of both 2.6mm and 1.5mm pixel pitch for the main rear wall, true black coating the display and reinforcing the strength of the units, particularly for floor displays. This has helped encourage more LED vendors to develop dedicated VP product ranges. However, the wider hardware and software VP market remains highly complex, with many technology vendors involved in the workflow. This complexity is slowly improving as software/platform led providers (such as Disguise and Pixera) focus on effective end-to-end management of workflows, but this remains a key area of development over the next 5 years.

Though still at an early stage, AI is likely to be another factor in the coming years, transforming complex VP workflows. This will primarily be achieved through algorithms to optimize rendering, animation, and post-production tasks, improving both efficiency and reducing timelines. In addition, machine learning is aiding in predictive analytics for better decision-making during production planning.

The combination of AI, state-of-the-art ProAV technology, and the creative industry will drive further opportunity for virtual production from traditional filmmaking into new verticals, effectively creating new markets.

“Vendors not currently involved should look to partnerships in adjacent technology to best position themselves for the coming growth. Developing an understanding of the multitude of technologies and processes in this complex and rapidly evolving market is a vital first step in the virtual production landscape,” concludes Rubin.