The COVID-19 pandemic has already dramatically reshaped how Americans shop, with e-commerce expected to grow 20% in 2020 as a greater proportion of users shift from in-store to online. Due to this transition to greater online shopping coupled with the increased financial uncertainty of the American public, Button expects that COVID-19 will also reshape how Americans pay for their shopping with a similarly dramatic increase in adoption of “buy now, pay later” payment programs (BNPL) at checkout.

The greatest limitation to BNPL adoption is its availability, i.e., whether the retailer offers its customers a BNPL program. Offering such a program in the checkout flow doesn’t happen with the flip of a switch. It requires a direct integration into the retailer’s point-of-sale system, which is an onerous process and a meaningful moat for providers in place. Leaders in the BNPL field include Klarna, Affirm, Afterpay and Quadpay — and PayPal made a major announcement in August that it would begin offering BNPL services.

In anticipation of this season’s increased adoption of BNPL, mobile commerce platform Button examined our marketplace to understand the current state of affairs as it relates to BNPL — how many retailers feature BNPL programs, which programs are most prevalent and how often do the BNPL programs compete head-to-head.

Using Button’s Commerce Intelligence, we analyzed the payment method used by consumers in our marketplace over the past 90 days. We reviewed nearly 500,000 transactions across more than 300 retailers. Key highlights included:

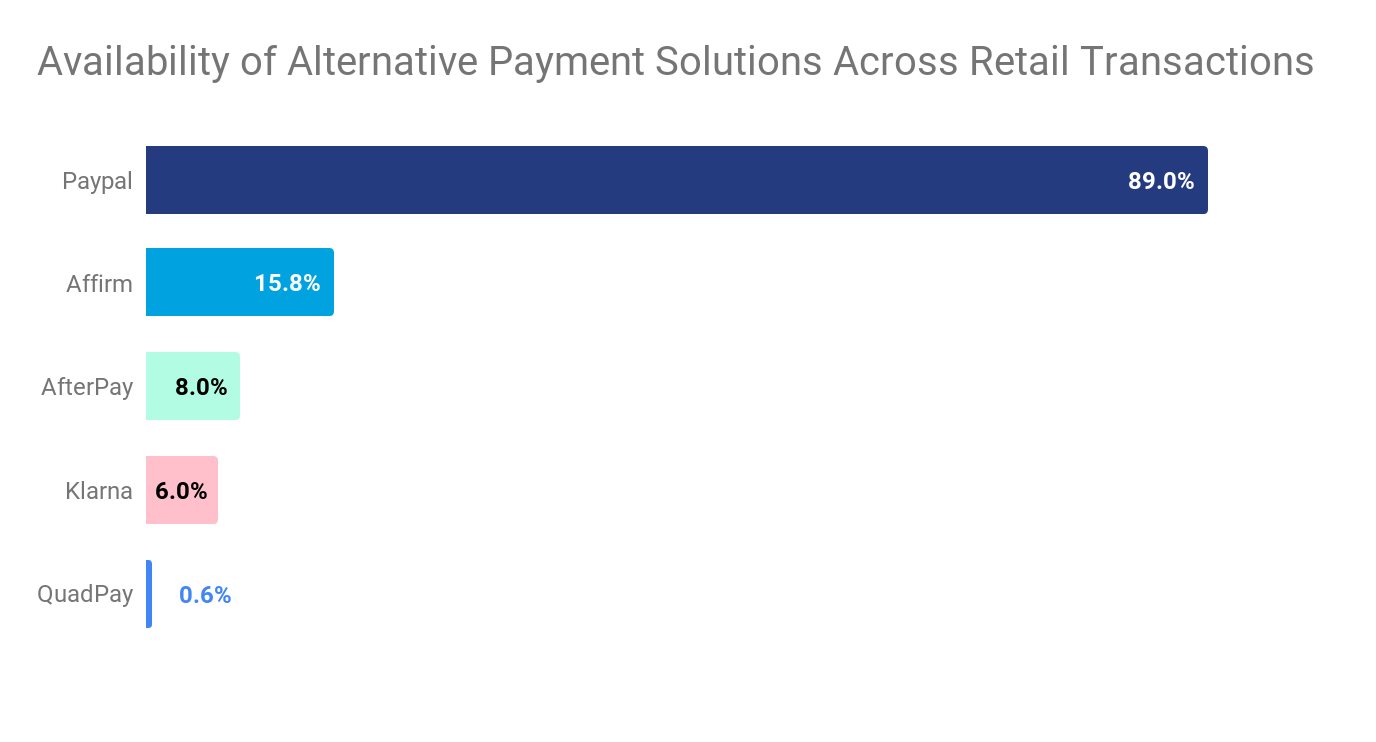

- Of nearly 500,000 transactions, Button observed five available alternative payment solutions: Afterpay, Affirm, Klarna, QuadPay and PayPal. While PayPal’s payment option is not exclusively a BNPL option like the others, we included it in this analysis to highlight the significant foundation upon which it can build its BNPL program relative to its competitors.

- PayPal had the greatest retailer coverage with a presence of 65% retailers. Afterpay was a distant second at 10%, then Affirm 6%, Klarna 5% and QuadPay 2%.

Image Credits: Button (opens in a new window)

It’s difficult to step out of PayPal’s shadow … the other payment solutions had the following overlap with PayPal of their respective retailer inventory: Klarna (87%), Affirm (80%), AfterPay (77%) and QuadPay (60%).