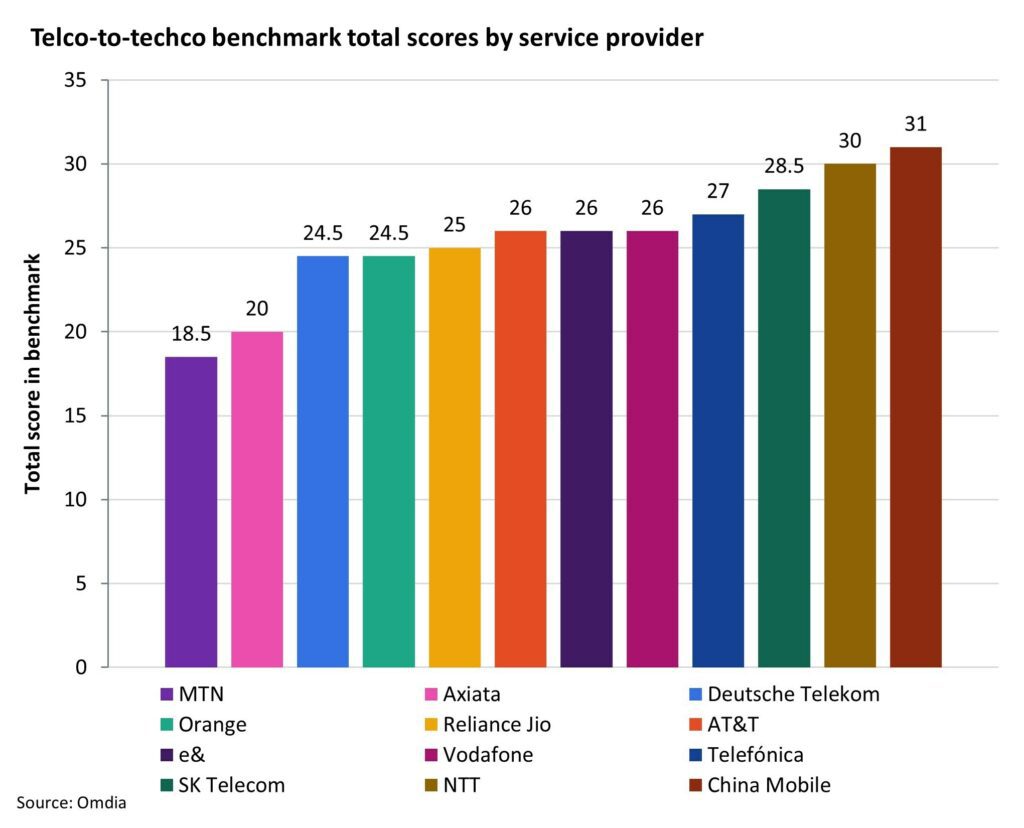

Analyst house Omdia has ranked the top mobile network operators in the world for their various progress with ‘tech-co’ reinvention, and placed a trio of Asia Pacific (APAC) firms in the top spots in the league table, leading the charge from their peers in Europe and North America. In order, China Mobile, NTT, and SK Telecom – in China, Japan and South Korea, respectively – are the best in the business, it said (see graphic, below), at combining traditional telecoms with adjacent ‘technology’ services. Generally, operators are making “good progress”, it said.

Telefónica ranks fourth in the benchmark, and highest among the non-APAC also-rans – reflecting its “progress as a provider of cybersecurity and other enterprise digital services”, said Omdia, via its dedicated Telefónica Tech business division, created in 2019. US-based AT&T, UK-based Vodafone, and UAE-based e& (Etisalat) are tied in fifth. Reliance Jio in India is just behind in sixth (eight in the list); France-based Orange and Germany-based Deutsche Telekom are joint-seventh (nine and 10, out of 12 in the list).

Axiata in Malaysia and MTN in South Africa bring up the rear. The likes of China Telecom and China Unicom (both in China), Softbank (Japan), Verizon and T-Mobile US (US), BT/EE (UK), América Móvil (Mexico), and Bharti Airtel (India) do not get a mention, along with others. Omdia said the study “assesses the efforts of 12 leading telecom service providers”, and does not actually suggest it is a definitive guide – although its picks will reflect its view of which operators are making a noise about their ‘telco-to-techco’ transformation.

Matthew Reed, a chief analyst at Omdia, explained: “The high cost of deploying 5G and fiber networks, combined with low growth in revenues for communications and connectivity services, is leading many telcos to reinvent themselves as techcos that provide technology services, primarily to the enterprise sector. A telco that has adopted the techco model successfully is a software-based organization that offers services in areas such as AI, big data, the cloud, and IoT, and can implement digital transformation for specific vertical sectors.”

China Mobile took 31 points out of a maximum of 40 in the benchmarking process, scoring well for the “scale of its… broadband platform”, plus its capabilities with AI, big data, and security, plus its portfolio of digital services and solutions for enterprises in various ‘vertical’ markets. Its revenue from selling new digital services (“digital transformation revenue”) accounted for 29.4 percent of its total service revenue in 2023, up 22.2 percent in the year.

NTT scored 30 out of 40; its strengths in software and enterprise services were remarked upon. SK Telecom scored 28.5/40; its strategy to be a “global AI company” is noted. As above, Telefónica ranked relatively well (27/40) because of its Telefónica Tech unit. AT&T, e&, and Vodafone scored for their statuses and strategies, respectively, as “early adopter of AI” ($6 billion in cost savings), keen acquirer of new digital assets, and strong advocate of enterprise sales and IoT technologies.

Vodafone’s move to hive off its IoT business as a “standalone unit in partnership with Microsoft”, which went live April 1, in order to “expand its IoT operation, already the largest of its kind outside China”, was remarked upon, too. Reed said: “Overall, the operators covered in the benchmark are making good progress towards a software-based operating model and with their development of enterprise digital services. But their vertical markets focus is less advanced generally and is an area that needs more work.”