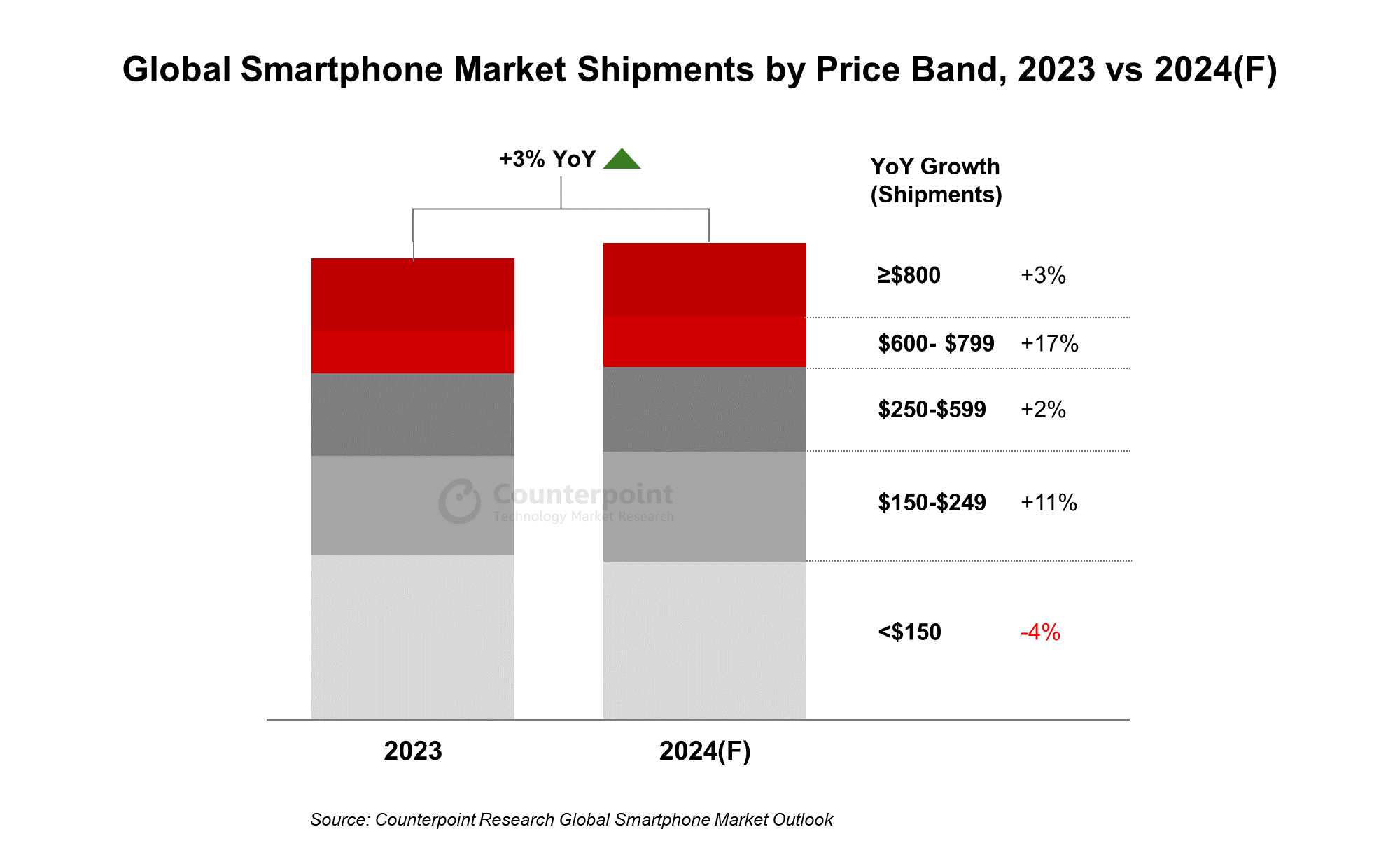

- Global smartphone shipments in 2024 are expected to increase by 3% to reach 1.2 billion units.

- The budget-economy segment ($150-$249) is expected to rebound from a challenging 2023, driven by a recovery in the CALA, India and MEA markets.

- The premium segment ($600-$799) is projected to grow 17% YoY thanks to Apple and Huawei.

- The market seems to have bottomed out, and we expect low-single-digit YoY increases in the longer term.

Global smartphone shipments in 2024 are expected to record a modest rebound of 3% YoY to reach 1.2 billion units, according to Counterpoint Research’s Global Smartphone Shipment Forecast. The budget-economy segment ($150-$249), which shrank YoY in 2023 due to macroeconomic headwinds, especially in emerging markets, and the premium segment ($600-$799) are expected to drive this rebound.

Unlike 2023, emerging markets such as India and the Middle East and Africa (MEA) are expected to drive the global smartphone market’s growth in 2024, supported by the budget-economy segment. The robust inventory levels in Q4 2023 are also expected to help.

The budget-economy segment ($150-$249), which experienced a noticeable decline in 2023, is expected to rebound 11% YoY in 2024, primarily driven by India, MEA and CALA (Caribbean And Latin American) markets. As inflationary pressures have eased considerably across Africa, and local currencies have stabilized in many countries, the consumer purchasing power has recovered, benefiting the $150-$249 segment.

Steady investments into the MEA and CALA markets by Chinese OEMs like OPPO, vivo, Xiaomi and Transsion Group have intensified the competition, stimulating the demand for budget-economy smartphones. Alongside the recovery of demand for IT devices in emerging markets, the intensified competition between Chinese OEMs will be the main growth driver in the segment.

The premium segment ($600-$799) is expected to maintain steady growth in 2024, rising 17% YoY driven primarily by older model flagships, with flip form factors also enjoying strong YoY growth. We expect GenAI smartphones and the fold segments to help support demand in ultra-premium, especially towards the latter half of the year. From a brand perspective, Apple and Huawei are likely to lead premium and ultra-premium segment growth, with emerging markets such as India and MEA driving iPhone growth, and China to continue being a key battleground for both.