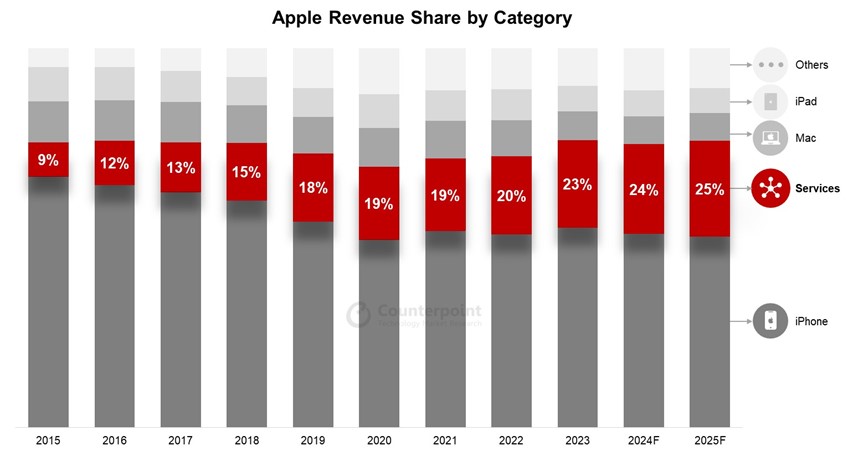

- We expect Apple’s services revenue to cross the $100-billion mark to account for one-fourth of its revenue by 2025.

- Antitrust lawsuits in the US and EU pressure are key risk factors, but they are likely to play out over a longer term.

- While the services segment is growing, iPhones will continue to capture around half of Apple’s total revenue.

- The growth in hardware and services will help Apple breach the $400-billion revenue mark for the first time in 2024.

Apple’s services segment is likely to capture one-fourth of the company’s total revenue in 2025, according to Counterpoint Research’s Apple 360 service. 2025 will also mark the year when services revenue crosses the $100-billion-per-year mark for the first time. Further, the company should breach the $400-billion revenue mark for the first time in 2024, supported by the growth of its hardware and services segments.

Sources: Company, Counterpoint Research

Commenting on recent legal and regulatory issues faced by Apple in the US and EU, Research Director Jeff Fieldhack said, “We know there is risk, but it is early stages right now. So, we are not expecting any impact to monetization of the iPhone installed base, at least not in the medium term.”

“As regards Apple’s relative silence around its AI strategy, well, that has now changed with the big hint dropped on Tuesday around the announcement for June 10 WWDC. Am I expecting to see something special? I wouldn’t be surprised – that’s Apple’s M.O.”

Apple’s growing installed base, which is over 2 billion devices currently, has created a flywheel effect on the growth of the brand’s services business. Apple Store, followed by Apple Care+, Apple Music and a round-up Apple One subscription, has driven inflection points for Apple with a growing device base.

Launched in 2023, AppleOne could become the single largest contributor to Apple’s services revenue. The tight software-hardware integration providing a unified and homogenous software and services experience to consumers, and a large installed base of premium consumers create a competitive advantage for Apple.

iPhones will continue to capture half of Apple’s revenue and remain the centerpiece of Apple’s ecosystem. Premiumization trends and growth in emerging markets are benefiting Apple’s iPhone business, with the latter likely to offset some of the volume declines seen in China earlier this year.

iPhone growth in emerging markets should also help with future growth for other Apple products as many consumers will be new users entering the iOS ecosystem. As these consumers become more dependent on their iPhones, they are likely to spend more on other Apple products.