Spotify continued its good run, growing 30% YoY in terms of music streaming subscriptions.

Music streaming platforms are focusing on increasing reach by making their services available on different platforms through initiatives like device partnerships and browser availability; Podcasts continue to drive growth.

Global online music streaming subscriptions spiked 35% YoY in Q1 2020 to reach 394 million subscriptions, according to the latest findings from Counterpoint Research. This was driven by increased usage of the OTT platforms as people stayed at home amid the COVID-19 outbreak. Promotional offers like free trials and subscription price cuts in emerging markets added to the growth. An increase in podcast genres on music streaming platforms was another big factor for people to tune in.

Research Analyst Abhilash Kumar said, “The growth in paid subscriptions (35% YoY) was once again more than the 20% YoY growth in monthly active users (MAUs). This indicates that people from the free MAU universe are upgrading to become premium subscribers for an improved experience. This also indicates that it is relatively difficult to bring users into the system, but once they come in, it is relatively easy to make them upgrade.”

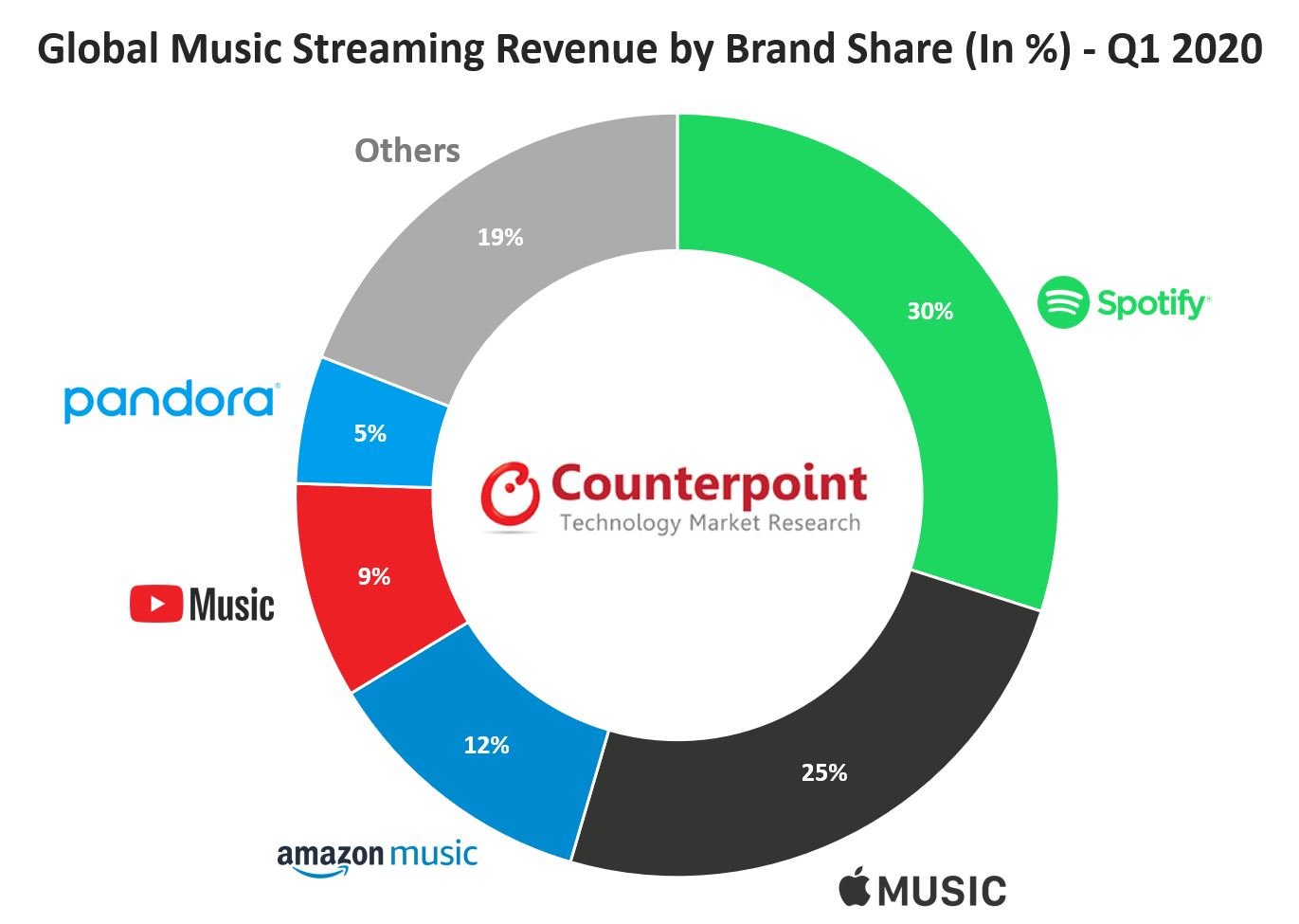

Spotify continued to lead the charts for Q1 2020 with a market share of 30% in revenue terms and 33% in terms of paid subscriptions. Apple Music followed with 25% revenue share and 21% subscription share. Amazon Music subscriptions grew a strong 104% YoY to capture the third spot. However, in terms of total MAUs, Tencent Music (with the help of QQ Music, Kugou and Kuwo) emerged the winner with a stronghold in China, accounting for 657 million MAUs.

Talking about the top performers, Kumar said, “Spotify growth was driven by strong performances in the Asia Pacific and Latin America. It has come up with attractive promotional offers in the emerging markets. To talk about its key market India, which it entered recently, it has made a big price cut on its yearly plan – from INR 1,189 (around US$16) to INR 699 (around US$9). Also, it kept its research game strong to tap different segments.

It came up with a new service Spotify Kids, targeting parents with small children, besides podcasts and playlists for pets. Apple Music expanded to 52 new countries and offered 6 months of free subscriptions there. Also, it is adding new features continuously on its platform, like with the iOS 13.4.5 release, users can now share their music on Instagram and Facebook stories, thus increasing social media engagements. The reason for Amazon Music’s 104% YoY growth is that its HD arm Amazon Music HD offered 90 days of free lossless music streaming in Q1 2020.”

Discussing the Q1 impact of the COVID-19 pandemic on the OTT industry, Kumar said, “Like we said in our Q4 2019 release, the OTT industry experienced an uptick as people stayed at home. However, the listening patterns have changed from listening while commuting to listening at home. Radio, news channels and podcasts related to wellness and meditation have grown. On the devices side, streaming time on smart audio devices and television grew even as listening hours on Android Auto and Car Play declined amid less commute.”

The race for subscriptions is heating up with every passing quarter. While the COVID-19 outbreak proved to be negative for most of the industries, it improved the overall scenario for the music streaming segment. Consumers getting some extra time to explore these platforms accelerated the user growth rate.

The comprehensive and in-depth “Global Online Music Streaming Market Tracker Q1 2020” is available to help track the market. Please contact press(at)counterpointresearch.com for further questions on our research or other press inquiries.