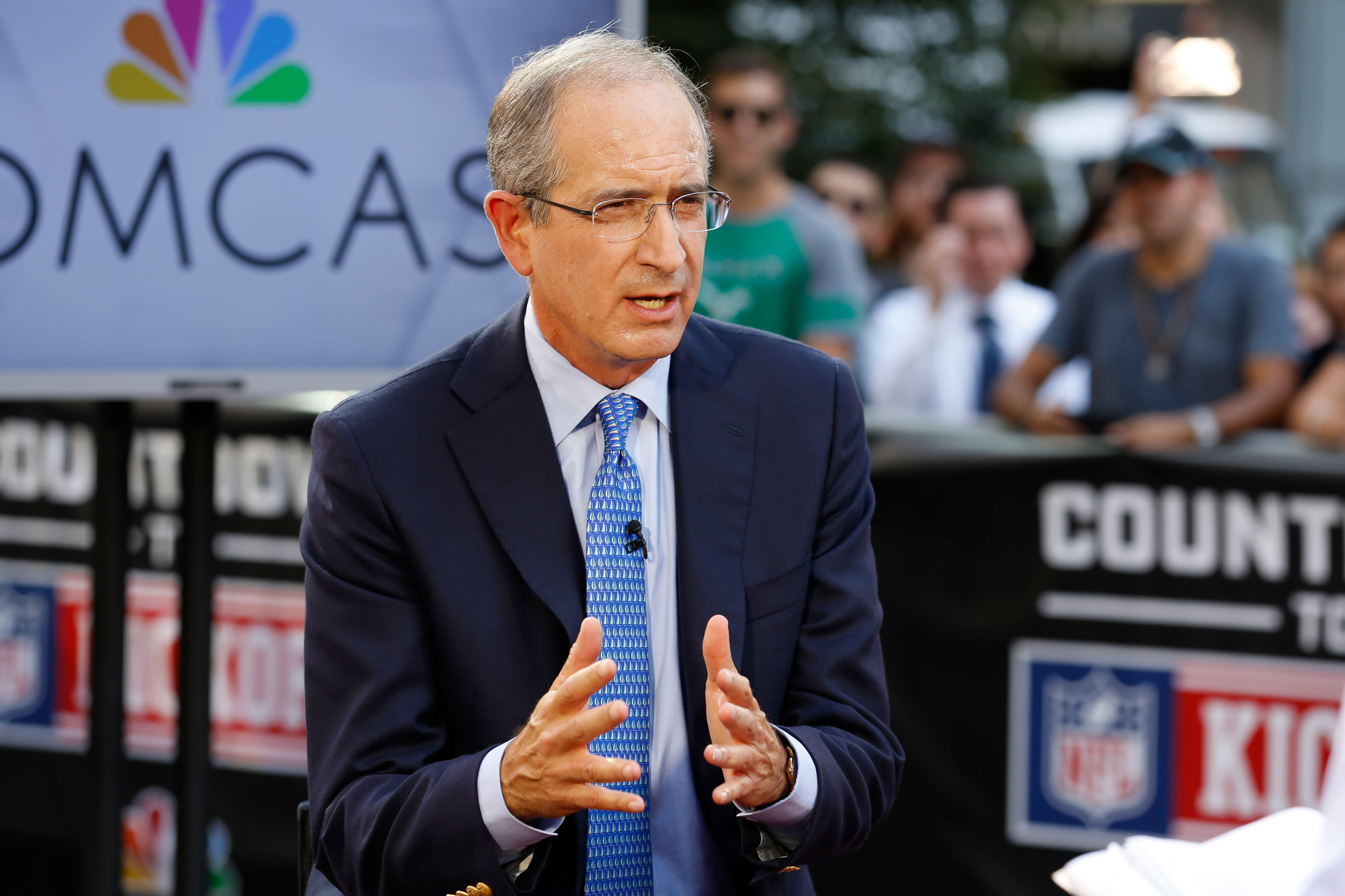

Brian Roberts, CEO, Comcast

David A. Grogan | CNBC

Comcast reported earnings for its third quarter of 2020 before the bell on Thursday, beating analyst estimates on the top and bottom lines.

Comcast also beat estimates for high-speed internet customer net adds and reported further growth to its new streaming service.

The stock was up about 1% after earnings were released.

Here are the key numbers:

- Earnings per share: 65 cents, adjusted vs. 52 cents expected, according to Refinitiv survey of analysts

- Revenue: $25.53 billion vs. $24.74 billion expected, according to Refinitiv

- High-speed internet customers: 633,000 net adds vs. 534,000 net adds expected, according to FactSet

NBCUniversal’s Peacock now has nearly 22 million sign-ups. The service, which has both a free, ad-supported tier and paid tiers, had 10 million sign-ups when Comcast last reported earnings in July. Comcast said in its report that Peacock is “proving to be a differentiating factor for customers considering Xfinity broadband and is also improving churn.”

“Peacock has exceeded every internal engagement metric without the benefit of the Olympics or content like The Office (Jan. 2021),” Comcast said.

The company had its best quarterly customer results in its history for broadband in the quarter, adding more than 633,000 high-speed internet customers, according to the report. Cable added more broadband customers in the first nine months of the year than in all of 2019, Comcast reported, including nearly 1 million customers in the second and third quarters.

Comcast’s European-based Sky division has continued to add higher-priced customer relationships and reduce churn, according to the report. Its quarter was strengthened in part by the return of sports, including record Premier League viewership on Sky Sports.

Comcast’s theme parks business, which is part of its NBCUniversal division, has suffered the most during the pandemic as closures and capacity restrictions strain revenue.

Theme park revenue fell nearly 81% to $311 million, according to the report. Comcast said that excluding theme parks, NBCUniversal EBITDA would have grown by 9% year-over-year.

California has kept theme parks closed under strict reopening guidelines that only allow them to resume operations after their counties reach a rate of less than one case per 100,000 residents. Universal’s parks in Florida and Japan have been able to reopen with limited capacity.

Filmed entertainment has also suffered during the pandemic, which interrupted movie production and theater premieres. Revenue for the segment fell 25% to $1.3 billion. The dip in theatrical revenue was partially offset by increased licensing and home entertainment revenue, including from the at-home release of “Trolls World Tour.”

Comcast’s Universal Pictures struck a deal with AMC Studios in July that could help both navigate the changed behaviors of consumers during the pandemic. Under the deal, AMC will show Universal films in its theaters but shorten the window of time before Universal can bring movies to consumers on-demand.

Here’s how Comcast’s divisions did for the quarter:

- Cable communications accounted for $15.0 billion in total revenue, up 2.9% year over year

- Cable networks accounted for $2.7 billion in total revenue, down 1.3%

- Broadcast television brought in $2.4 billion in total revenue, up 8.3%

- Filmed entertainment brought in $1.3 billion in total revenue, down 25%

- Theme parks brought in $311 million in total revenue, down 80.9%

This story is developing. Check back for updates.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC.

WATCH: Why Quibi shut down after fighting the streaming wars for only six months: CNBC After Hours