5G smartphones to make up around 20% of total sales in 2020; Apple to drive 5G adoption in Q4 2020 with iPhone 12 line-up.

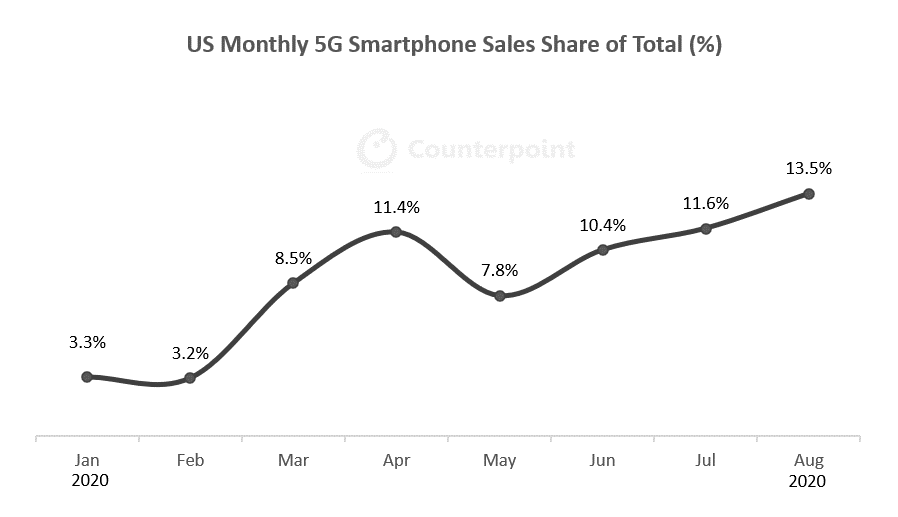

5G smartphone sales accounted for 14% of total US sales in August, up from just 3% in January 2020, according to Counterpoint’s latest North America Channel Share Tracker research. Despite the COVID-19 impact on both supply and demand, consumers have shown increased interest in 5G devices as they continue to move down price tiers. 5G sales will likely spike even higher in Q4 when Apple launches its latest iPhone 12 line-up with 5G.

Research Director Jeff Fieldhack said, “5G penetration was just around 1% in 2019. However, it has steadily increased this year as more OEMs launched 5G devices. After Samsung and LG initially launched 5G devices in June 2019, OnePlus soon followed in August 2019. Motorola launched its first 5G smartphone in July this year while T-Mobile launched the most affordable 5G device in the market – REVVL 5G, through a white-label partnership with TCL. We expect more OEMs to launch 5G devices as 5G chipsets continue moving down price tiers. Carriers want more of their subscriber base on 5G networks and are pushing OEMs to launch more affordable 5G smartphones.”

Research Director Jeff Fieldhack said, “5G penetration was just around 1% in 2019. However, it has steadily increased this year as more OEMs launched 5G devices. After Samsung and LG initially launched 5G devices in June 2019, OnePlus soon followed in August 2019. Motorola launched its first 5G smartphone in July this year while T-Mobile launched the most affordable 5G device in the market – REVVL 5G, through a white-label partnership with TCL. We expect more OEMs to launch 5G devices as 5G chipsets continue moving down price tiers. Carriers want more of their subscriber base on 5G networks and are pushing OEMs to launch more affordable 5G smartphones.”

Fieldhack added, “However, the biggest shift will come when Apple launches its newest iPhones in Q4. Apple has a market share of around 40% or higher in the US. When Apple begins selling 5G iPhones, this will sharply increase the market share of 5G devices on a monthly sell-through basis. Overall, we expect 5G smartphones to make up around 20% of total sales in 2020.”

Commenting on 5G average selling price (ASP) trends, Senior Research Analyst Hanish Bhatia said, “Over the last year, we have seen 5G ASP drop over $300 to reach $730 in July 2020. Samsung was the first to begin launching devices below $600 with the Galaxy A71 5G in June and continued it with the A51 5G in August for $499.99. In H2 2020, more OEMs started offering affordable 5G smartphones, mainly powered by Qualcomm’s Snapdragon 765G or Samsung’s own Exynos 980 processor. Such devices include the LG Velvet, REVVL 5G and the upcoming Pixel 5 and Pixel 4a 5G. T-Mobile is trying to drive down 5G smartphone prices even further. It has announced the first MediaTek-powered 5G smartphone through its custom LG Velvet 5G. The device itself costs $588, compared to the Snapdragon 765G version from AT&T for $599 and Verizon’s ‘UW’ mmWave variant for $699. Verizon continues to have the highest 5G Smartphone ASP due to its requirement of mmWave, which typically adds around $50-$100 to the BoM (Bill of Materials) cost.”

Research Analyst Maurice Klaehne added, “The most popular 5G smartphone so far in 2020 is the Samsung Galaxy S20 Plus 5G. Despite the slow start to S20 sales due to COVID-19, we saw a boost in sales in June and July because of pent-up demand and stimulus money. We continue to see demand rise due to the launch of more affordable 5G smartphones by Samsung in Q2. Previously, 5G smartphones were considered expensive, putting them out of reach for many who could not afford a $1,000+ device. Now, with devices entering the sub-$600 price band, 5G is becoming more accessible and attainable for consumers. According to our latest surveys, sub-$600 5G smartphones have seen increased interest from consumers at carriers with low- and mid-band 5G networks. This is because mmWave 5G is still not available nationwide, thus limiting useability for many consumers. Verizon has said it would have nationwide low-band 5G available by the end of the year through DSS (Dynamic Spectrum Sharing). This will help increase competition between the carriers and continue driving down 5G smartphone ASPs.”