Chinese OEMs and Taiwanese ODMs are beginning to gain market share and are challenging their US counterparts soon.

New Delhi, India, May 7, 2019 : Ever since the rise of Big Data, there has been a lot of debate about the optimum way to store and process data. Today, both enterprises and individuals want to put their data on the cloud. Given this trend, Counterpoint Research expects the cloud services market to grow at a double-digit rate over the next five years. We estimate that in 2018, the cloud server market grew at 28% to US$86 billion.

The growth momentum in the cloud services space will also benefit cloud server manufacturers. So where is the demand coming from?

Prachir Singh, Senior Analyst at Counterpoint Research said, “Our analysis suggests that several factors are responsible for the rising demand for cloud servers. One of the main consumers for cloud servers are big data center companies and cloud service providers. Examples of big data center companies include the likes of Equinix and Digital Realty Trust, both of whom are real estate investment trusts or REITs. Among cloud service providers, the likes of Microsoft, Amazon Web Services (AWS), Google and other such companies are the major users of cloud servers. These companies also provide Infrastructure-as-a-Service (IaaS) whereby they offer instant computing infrastructure which is managed over the internet.”

Brady Wang, Associate Director at Counterpoint Research added, “According to our research, Google, Amazon, and Microsoft are spending heavily to increase their share in cloud services as well as the data center business. New players are also emerging in this sector. In the US, Facebook, Apple, and Intel are some of the big names making a mark in the data center segment. In China, Alibaba, Tencent, Baidu, and China Telecom are spending heavily to boost their data center businesses.”

Data centers and cloud services is already a multi-billion dollar industry. Today, both big and small enterprises depend on data centers and cloud services providers for their operations, For example, Instagram takes services from Facebook data centers while Netflix is a big consumer for AWS. Recently, Google announced its new cloud gaming service, Stadia, which opens up a new market for these cloud services providers. Content remains the king from video to gaming to music to smartphone apps to user-generated content all need an increasing amount of cloud storage. Further, the growing adoption of Artificial Intelligence across different applications is in parallel driving need for greater server processing power and thus semiconductor capabilities within the servers.

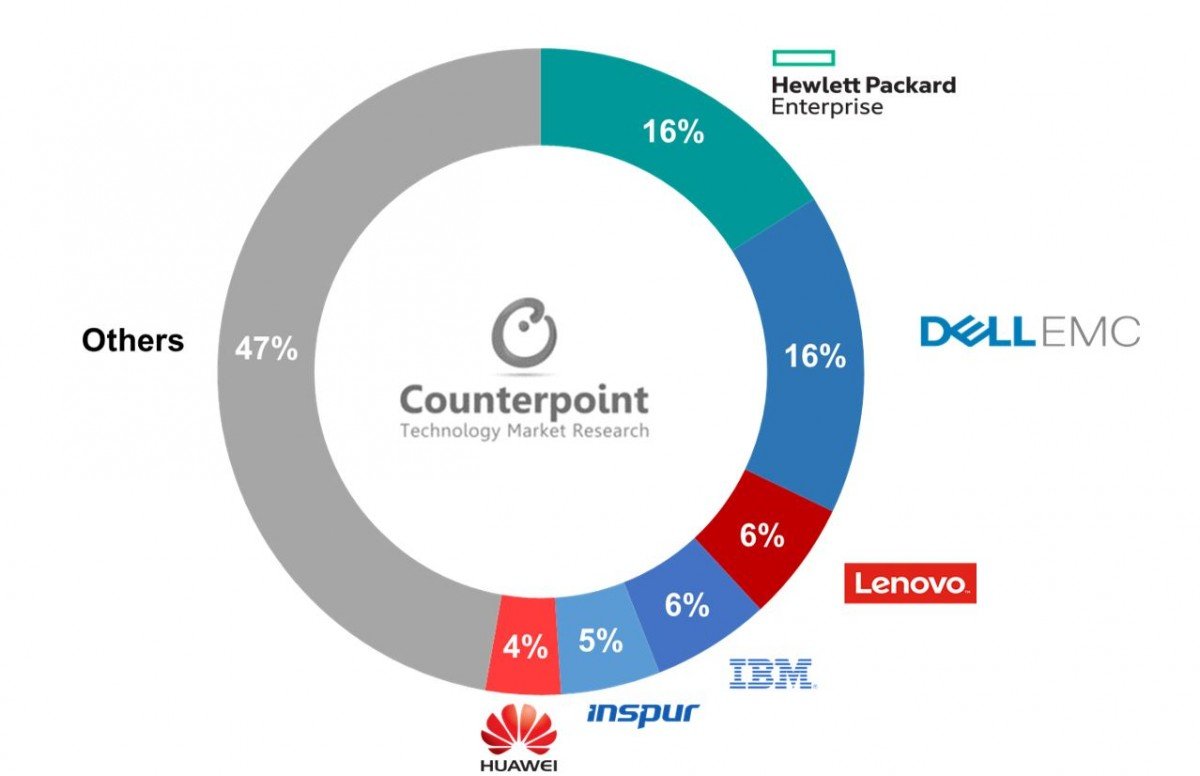

Such developments are helping leading server manufacturers like Dell EMC and HP Enterprise grow fast. Globally, in 2018, the top five companies held about 49% of the market share by revenue in cloud server manufacturing. Dell EMC and HP Enterprise are the biggest players, both holding 16% market share in 2018 in terms of revenue. Their offerings range from industry-grade racks to blade and tower servers. IBM is also a major player with its IBM Z mainframe servers. Other big players include Cisco, Oracle, and Lenovo.

But even as western companies have so far dominated the cloud server manufacturing business, in recent years Chinese OEMs are gaining market share. The likes of Inspur Power Systems and Huawei are the biggest contributors from China. In 2018, Inspur Power Systems’ revenue grew 72% YoY while Huawei’s server business grew 33% YoY. In the cloud server manufacturing segment, Taiwanese ODMs are faring much better. Players like Foxconn, Wistron, Inventec and other such ODMs have a 39% market share by revenue in the cloud server manufacturing space.

Cloud Server Market by Revenue Share % (US$) (2018)

Source: Counterpoint Research Cloud Computing Tracker

Commenting on the growth being witnessed by Chinese and Taiwanese cloud server manufacturers, Wang said, “Chinese and Taiwanese companies are gaining ground in terms of shipments due to the lower prices that they offer. The larger data center companies are now buying cloud servers directly from these ODMs to cut costs. This has made the Chinese companies’ share increase drastically in recent years. For example, Inspur Power Systems increased its shipments share to more than 7% in 2018 from 3% in 2016. ODMs too increased their share in shipments to 25% in 2018 from 19% in 2016. We expect this share to increase in the coming years as more and more Chinese companies get into the data center business.”

Another industry benefitting from the rise in data centers and cloud service providers is the server microprocessor market. The big players in this segment are Intel and AMD. Intel is by far the biggest contributor, grabbing more than 97% market share by revenue in 2018. AMD, which held less than 1% share two years ago, has now captured 2% market share due to their new offering EPYC.

Counterpoint Research believes that the future is very bright for cloud server manufacturers. This is mainly due to the meteoric rise of a data-driven ecosystem. Cloud services will now use advanced technologies such as AI (Artificial Intelligence), Machine Learning (ML), and Deep Learning alongside low-latency connectivity technologies such as 5G, which will help business and enterprises increase efficiency and power newer applications.

However, the biggest challenge for cloud server manufacturers as well as cloud service providers will be security. HP Enterprise has a platform, HPE Oneview, to efficiently manage and secure the data servers. We expect to see more of such bundled solutions in the future. We expect that the battle to be the lead cloud services provider will intensify in the coming years.