Rho Technologies, the NYC-based fintech behind Rho Business Banking, has raised a $15 million Series A round led by M13 Ventures with participation from Torch Capital, and Inspired Capital. The company will use the proceeds to further expand their commercial banking platform aimed at high-growth businesses, starting with today’s launch of Rho AP. The platform is oriented towards companies that need more autonomy in business banking and will map quite well to the current distributed nature of work, post-pandemic.

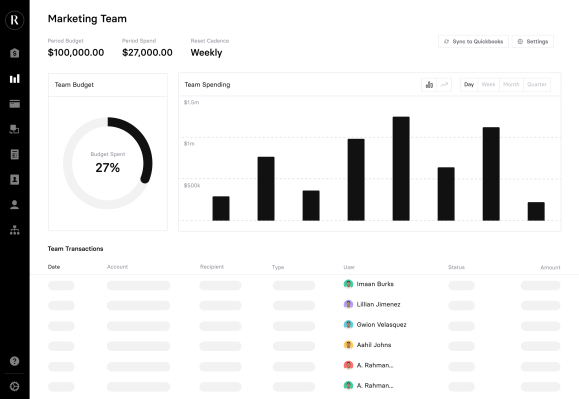

After raising capital and launching in December 2020, the platform now claims to be handling over $2 billion per year in annualized transaction volume for its clients. Rho AP expands on the core banking platform, by enabling companies to run full accounts payable lifecycles right within Rho, meaning invoices are uploaded, approved, coded, and paid – all within Rho. Companies no longer need another payables solution in addition to their bank account.

Rho’s platform approach consists of a single solution that encompasses both collaborative finance software and commercial-grade banking. It was founded by former Point72 and Deutsche Bank alum Everett Cook (CEO) and British-Canadian serial entrepreneur Alex Wheldon. Banking services are provided by Evolve Bank and Trust, member FDIC.

In a statement, Cook said: “At Rho, we are dedicated to empowering the teams that run today’s growing companies. We’ve developed the modern commercial banking platform built around the way companies operate today: distributed, team-oriented, transparent and built for scale. Rho AP is the next step on our mission to help teams work better together with money.”

Latif Peracha, General Partner at M13 and board member at Rho said: “We knew Rho had product-market fit when we discovered that several of our portfolio companies which span different sectors and sizes chose Rho for their banking needs. We believe there is an opportunity to build a powerful brand in business banking that treats the enterprise – and specifically, the CFO – as a consumer, and Rho has done that with a fully integrated product that makes managing a business much easier.”

Wheldon said: “Having built and scaled multiple businesses, I’d always found that commercial banking was a major point of friction. Rho is empowering the whole organization to work better together by removing the silos and bottlenecks associated with finance.”